✒️#23. Clout shaming

Black mirror, thirst traps, and banks

Good morning afternoon!☀

I was going to send out a nice short one on Monday, but got so incensed with the SVB situation that I decided to send this out today. Enjoy.

👎 Silicon Valley Bank has had a bad couple of days

Earlier this week, Silicon Valley Bank made a strategic move to improve their financial standing. As a result, they got absolutely annihilated by mimetic Twitter clout monsters. In exchange for anonymous likes, the clout monsters caused a bank run, scuttled a $2.25 billion raise led by one of the greatest investment groups of all time, and forced the seizure of one of the drivers of Western innovation over the past 20 years.

🏦 Who?

Although not everybody knows what Silicon Valley Bank is, they are not what one Business Insider columnist called “a little known California bank.” Silicon Valley Bank is one of the 20 largest banks on the planet. It provides banking services specifically tailored to VC funds and start-ups. It’s also not one of the neo-banks that’s popped up in the last 5 years. It’s a storied bank that began in 1982 and has dutifully provided start-ups the banking they need to grow while traditional banks stayed away from the cash-strapped, unprofitable customers.

SVB’s model is predicated on the fact that enough of their early customers will grow into huge successes and they will benefit from being an early supporter. In short, SVB helps the start-ups access and use capital and proves it’s a good banking partner. As the start-ups grow and raise more money, they become full-fledged companies with large deposits, complex banking needs, and ultimately an acquisition or public offering. SVB is then rewarded for that early service. This model has worked successfully for 40 years. SVB has become the go-to bank for start-ups. Major banks like JP Morgan Chase have copied this business and product development style to capitalize on the huge growth in the tech sector.

In 2021, like most companies tied to the tech sector, Silicon Valley Bank grew much faster than anticipated. With record amounts of funding going into venture funds and then into start-ups, deposits blew up. Hooray! SVB’s deposits grew from ~$62 billion in 2019 to over $189 billion by 2021.

As deposits grew, SVB couldn’t grow their loan book fast enough to generate the yield they wanted to see on the new capital. So, they put a lot of that money into mortgage-backed securities (MBS) with a weighted average yield of ~1.6%. That was an alright return when interest rates near zero. But as interest rates have risen in the last year, the value of SVB’s MBS portfolio dropped because now risk-free T-bills give a much higher yield than 1.6%.

SVB did paint themselves into a corner with this decision. Because SVB’s MBS portfolio was termed “available for sale” rather than “hold to maturity,” it was marked to market, meaning the falling value wasn’t just a balance sheet problem. It hit the bottom line and was an earnings problem. Moreover, their MBS portfolio, bought in an ultra-low interest rate environment, was unhedged against rising interest rates, and they have an undiversified client base that is put under unique pressure in high interest rate environments.

So, this week they ripped the band aid off to move into a higher yield shorter duration instrument, sold ~25% of that MBS portfolio for a $1.8 billion dollar loss with the intention of repurposing that capital into shorter duration, more secure, higher yield bonds. SVB estimated this move would pay back in 3 years and ultimately put them in a better position.

Although SVB’s move made sense, a $1.8 billion loss on the balance sheet still hurts. And they unfortunately did this on the heels of the insolvency of Silvergate, an unrelated crypto bank, and weren’t incredibly clear as to the rationale at the time. They announced their intention to raise $2.25 billion to shore up the balance sheet. General Atlantic, an incredibly well-respected investor, was in for half a billion. A plan was in place.

But then clout monsters entered the arena, and things turned upside down for SVB.

🧌Trolls, assemble!

Pining for views and clicks like saplings clamoring for the sun in a forest, our fear mongering “fintech gurus” began calling SVB’s move a liquidity crisis and predicting the end of the bank. Words like “fire sale” were incorrectly used as clickbait and sparked fear in an industry of cash-strapped stressed out founders.

More clout monsters got involved, laying their thirst traps in an industry they don’t understand. The little monsters drew connections between SVB’s strategic decision and Silvergate’s completely unrelated recent insolvency, and spread the dogma of a crumbling society and a bank in dire straits.

In response to the clout monster offensive, SVB’s CEO made the unfortunate mistake of telling us all the truth: SVB was fine. It was so fine, in fact, that the only thing that could get it in trouble is the same thing that gets any bank in trouble. A bank run. A bank run you say? Clout monsters love bank runs.

Amidst the chaos, adults showed up. Investors with deep ties to SVB explained not only SVB’s financial situation (healthy), but also the importance of SVB to the entire Western innovation complex. Without SVB, start-ups would never have had banking partners, and companies like Apple, Moderna, Uber, SpaceX, etc. might never have existed (NBD?).

Samir Kaji, known as “the VC banker,” went into detail on Twitter explaining that the only real risk for SVB (and any other bank in existence) was a hype-driven bank run.

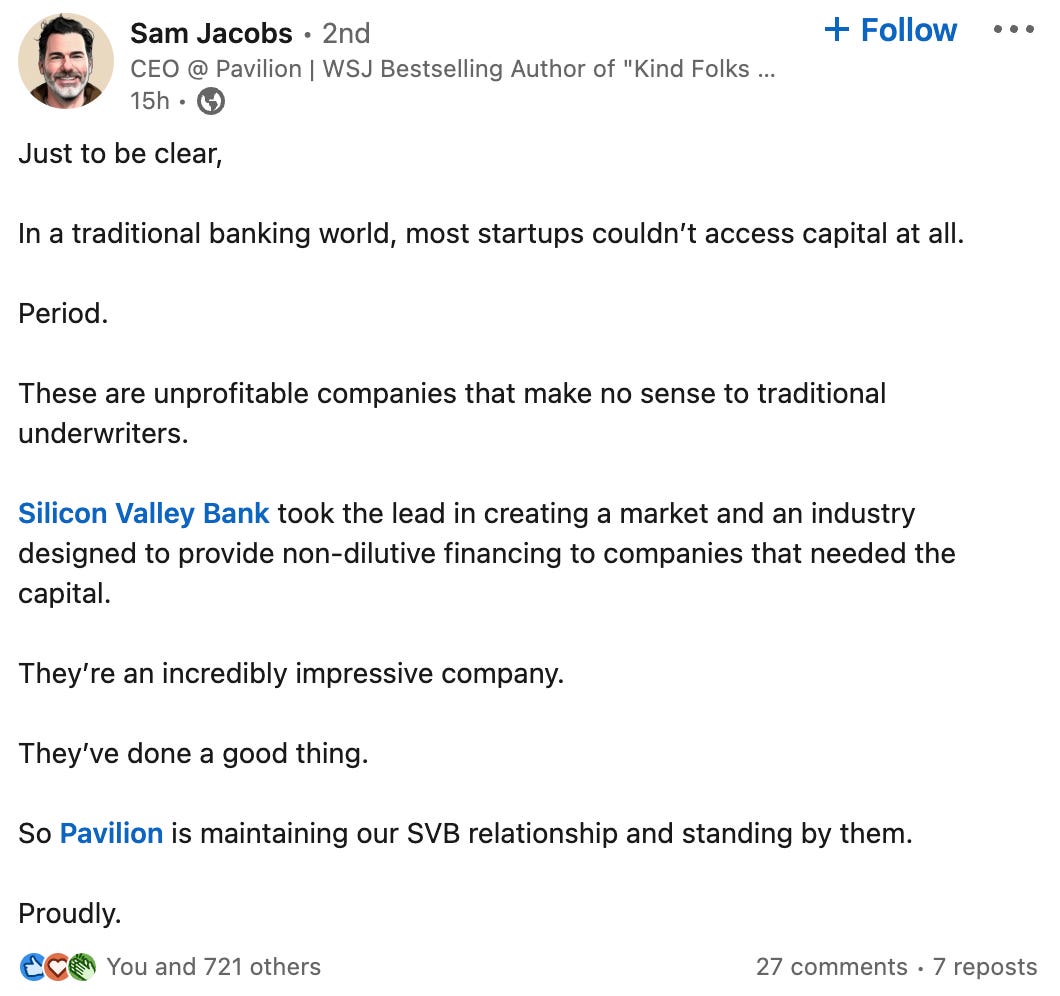

But the clout is so tasty and the little monsters couldn’t be stopped. Soon, my absolute favorite social media personalities, “thoughts and prayers” LinkedIn try-hards, began popping up. I kick myself for not saving this almost exact post when I saw it:

SVB is a good bank. It has lots of good people. Thoughts and prayers.

So sad 🙏

….#fintech #VC #start-ups #everything [CLOUT CLOUT CLOUT LIKES]

At this point, several VC funds were urging their portfolio companies to either “do what you feel is best for the business” or, in some cases, outright withdraw money from SVB. Because the clout monsters were winning and start-ups understandably need to look out for number one. Start-ups die an instantaneous death if they can’t use their cash, and now game theory was at play and deposits were no longer safe. SVB’s financial standing barely mattered anymore.

Nothing real mattered anymore. Start-ups and VC funds emptied their bank accounts because their money was no longer safe. Allocators refused to comply with capital calls that directed money to SVB. SVB’s stock dropped 87% in two days. The General Atlantic deal fell through. The bank was exploring a possible sale until this morning when trading halted and the FDIC formally shut it down.

Early next week, many start-ups and funds will receive confirmation that they only have a fraction of their money left. The start-ups will shutter and the funds will be unable to raise a subsequent fund.

🤔 So what have we learned?

Hype is reality. We learned this in 2020 with the WallStreetBets Reddit group reviving AMC and Gamestop and causing a short squeeze. We called them funny traders who put skin in the game and won big from their basements. But this time the clout monsters, without any skin in the game and minimal knowledge, have unwittingly orchestrated the death of a major force of innovation and wealth creation. Maybe they got some new followers. Maybe even a sponsored ad deal from one of those Instagram supplement brands 😬.

Narrative drives more than we give it credit for. In simpler times, narrative was about controlling perception. But today, perception quickly becomes reality. This is the corporate version of the Black Mirror episode aptly titled “Nosedive,” where a poor social score spirals into life in prison. Marketing heads will soon be architects of the future.

This death knell happened almost entirely via social media. This month, Congress has been actively discussing (1) the potential ban of Chinese social media giant TikTok and (2) Section 230, which frees social media companies from being liable for what people post on their platforms. This is fodder for both of those conversations.

In a time when an increasing amount of start-up activity is directed toward defense, energy, and infrastructure, it’s hard to imagine a more effective way for China to want to use TikTok than how we just used Twitter on ourselves.

And now into the Section 230 talks, regulators have more firepower to ask tech companies what role they could or should have played in tampering the hysteria that caused a hype-driven bank run on one of the largest banks in the world.

Everything I’m hearing is that SVB’s demise is representative of SVB, not the larger banking sector. SVB had idiosyncrasies that brought this 36-hour bank run to bear. But the clout monster army still exists, and cooler heads will eventually have to fight it.

This stuck with me:

We can still have nice things:

— Nico

www.nicochoksi.com | @nico_in140

Did somebody send this to you? Sign up below to get the next one in your inbox: